What’s New in the CU

THE 411 - keep informed on what’s happening at KFCU!

System Upgrade Complete

We will be upgrading our system from Wednesday, November 1st to Thursday, November 2nd. Please visit the Technology Upgrade for more information.

Silicon Valley Bank Collapse - How Does It Affect Your Account Here At Kahului FCU?

The collapse of Silicon Valley Bank last week is the second largest failure of a financial institution in U.S. history. The bank was shut down and put under the control of the FDIC following a 48-hour bank run and capital crisis. On March 12, regulators also shut down Signature Bank.

Credit union deposits are safe!

As a credit union member at Kahului Federal Credit Union, you are an owner of our not-for-profit financial cooperative. Credit unions’ first priority is your financial success, and we focus on financial security.

Kahului Federal Credit Union was chartered 68 years ago, and we are committed to serving our community. You can be assured that your money is safe and sound at our credit union. We have an experienced team to serve you and answer any questions or concerns.

Credit union deposits in federally insured credit unions are safe and secure.

Federally insured credit unions offer a safe place for credit union members to save money. These deposits are protected by the National Credit Union Share Insurance Fund and insured to at least $250,000 per individual depositor – the same as any other federally insured financial institution.

Credit union members have never lost a penny of insured savings at a federally insured credit union.

You can visit MyCreditUnion.gov for more information about the National Credit Union Share Insurance Fund coverage for consumers.

Please visit our website at www.kahuluifcu.com, or call (808) 871-7705 with any questions. Again, your money is safe and secure at our credit union and protected up to $250,000 per individual depositor.

In addition to our credit union-specific resources, you can find more information about the credit union difference on the Credit Union National Association’s Advancing Communities website at advancingcommunity.com.

New for 2024 - Membership Drive

Promotion Period: January 2, 2023 through March 29, 2023

Important Message

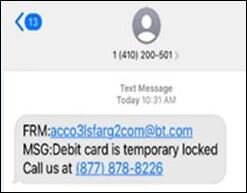

Several of our members have recently received a text message that appears to be from us.

This is a spoof attempt!

We will never text you about your account or loan. Do NOT open the link as it may contain malware.

Please check our Security Tips section to keep yourself informed about scams.

Notification of Changes in Fee Schedule

The Credit Union has made changes to its fee schedule. These changes will be effective on June 01, 2021. Members should be receiving a copy with your 1st quarter statement, which should arrive in the beginning part of April. Members with eStatements will receive a copy of the fee schedule in the mail. You can obtain a copy of the revised fee schedule at our branch or by calling us at (808) 871-7705; or clicking on the link below. Your acceptance and agreement to the revised terms will be shown by your continued use of any existing or new account(s) or services after the effective date.

Fee Schedule effective 06/01/2021

Interactive Voice Response System for VISA Debit Cards

We are excited to announce our new self-service Interactive Voice Response System. This new service will allow you to select your own PIN when you activate your new VISA debit card. If you forget your PIN, you can use the service to reset your PIN instantly. No more waiting for your PIN to arrive in the mail!

Call (800) 757-9848 to reset your PIN today.

MOBILE DEPOSIT CAPTURE UPDATE

Mobile Deposit Capture

We are pleased to announce that we have updated our mobile deposit capture. You can now:

Make deposits to your checking or savings

$6,000 daily single deposit limit and $10,000 aggregate deposit limit.

Don’t forget these advantages in using mobile deposit capture:

Make check deposits at your convenience.

No more driving and waiting in line to make your check deposits.

Best of all, this service is FREE!

Please check the Mobile Deposit Capture FAQs for more information

American Express Says Farewell to Travelers Checks

Towards the ending of November, we received notification from American Express, that they will be ceasing the supply and sale of their travelers checks in the United States effective March 31, 2021.

This means that we will not be offering travelers checks after that date.

We have been assured by AMEX that they will continue to honor the redemption of travelers checks beyond that deadline. However, we encourage members to redeem their unused travelers checks as soon as possible.

MOBILE APP NOW AVAILABLE!

We are excited to announce the launch of our own mobile branded app!

The app has the same functions as your Virtual Branch without the hassle of using your smartphone’s web browser.

Check your account balances

View up to a year’s worth of transaction history

Make transfers between accounts or to your loan

Change/Reset your password

Use biometrics after your initial log in. No more typing in your password at each log in!

Go to the Mobile Apps page to download the app to your smartphone.

App Icon

Launch Screen

Login Screen

Kahului FCU is Supporting the Fed’s Amendment to Delete the 6 Transaction Limit on Savings Deposits

This is just one more way we’re trying to CARE FOR OUR FAMILY by granting more flexibility to access your savings deposits at a time when we know our Members are facing financial hardships due to the coronavirus pandemic.

On Friday, April 24, 2020, the Federal Reserve Board (FRB) announced an Interim Final Rule to amend the reserve requirement of depository institutions to delete the six-per-month limit on transfers and withdrawals made from “savings deposit” accounts.

What does that mean for our members?

You can now make an unlimited amount of transfers and withdrawals from your regular share account.

You no longer will need to head into the credit union to transfer funds between accounts or to withdraw from your account.

You can make transfers yourself via online banking or audio response all on your own time.

Please note that this change may just be temporary, but we have to await clarification from the FRB before we can address that with certainty.

Notification of Changes in the Terms of the Accounts and Services of Your Credit Union Agreement

The Credit Union has made the following change to its Funds Availability Policy.

Generally, beginning on the effective date herein your deposits of checks will be available for withdrawal on the first business day after the day we receive your deposit as explained in our full Funds Availability Policy Disclosure. Generally, this change will adjust dollar thresholds for inflation increasing funds available more quickly than under our previous policy. Certain exceptions will continue to apply. You should be sure to read all provisions of our Funds Availability Policy carefully in order to fully understand when funds may be available from certain deposits.

These changes will be effective on June 01, 2020. Your acceptance and agreement to the revised terms will be shown by your continued use of any existing or new account(s) or services after the effective date.

Click here for your copy of the revised Funds Availability Policy Disclosure

Security Tips

HOW TO PROTECT YOURSELF FROM FRAUD – State of Hawaii’s Fraud Prevention and Resource Guide - Financial and consumer fraud happens right here in our islands! This state multi-agency guide was developed to introduce you to common scams happening in our islands today, to offer information on how to protect you and your family and to let you know where to get help.

COVID-19 (Coronavirus) Related Cyber Scams - With the COVID-19 pandemic affecting all of us, fraudsters are quick in trying to catch the unsuspecting person in a time of panic. The Hawaii-Pacific Electronic Crimes Task Force has issued a statement of the types of scams that are circulating and how to recognize them.

CISA Tips for Secure Holiday Online Shopping - With the holidays quickly approaching, fraudsters are gearing up for the online holiday shopping season. The United States Secret Service has collaborated with the Cyber Security and Infrastructure Security Agency with these tips before checking out your online holiday cart.

CFPB Debt Collection Scams Video - Dealing with debt collection issues can be challenging—especially when you’re not sure if the person you’re being contacted by is a legitimate debt collector or someone trying to scam you.

Phishing Tales - Adult Protective Services announced a new text scam that has hit Hawaii. This messaging scam appears to come from your financial institution, but in reality it originates from scammers who are attempting to gain personal information from you.

Be aware, your credit union would NEVER:

+Send a text message to you

+Call you to ask for any personal information such as your SSN, account number or PIN

Member Benefits*

Kahului FCU considers insurance an important part of your financial well-being. To help you protect what matters most in your life, we’ve joined with TruStage Insurance making life insurance products available to our Members that are budget-friendly and built on credit union values.